- Regulatory Compliance: Fintech operates in a highly regulated environment. Implementing a CLM system requires deep integration with regulatory requirements such as KYC (Know Your Customer), AML (Anti-Money Laundering), GDPR (General Data Protection Regulation), and industry-specific regulations like PSD2 (Payment Services Directive 2). The CLM system should align with these regulations to ensure compliance.

- Security and Data Privacy: Fintech deals with sensitive financial data. The CLM system needs robust security measures to protect sensitive information. Encryption, access controls, and data privacy protocols must be paramount to safeguard customer and transactional data.

- Integration with Financial Systems: Integrating the CLM system with core financial systems like banking platforms, payment gateways, and accounting software is crucial for a seamless flow of data. APIs and secure connections are essential to ensure data accuracy and integrity.

- Customization and Scalability: Fintech solutions often have unique contract requirements. The CLM system should be customizable to accommodate specific clauses, terms, and regulatory nuances. Additionally, it should be scalable to handle growing volumes of contracts and transactions.

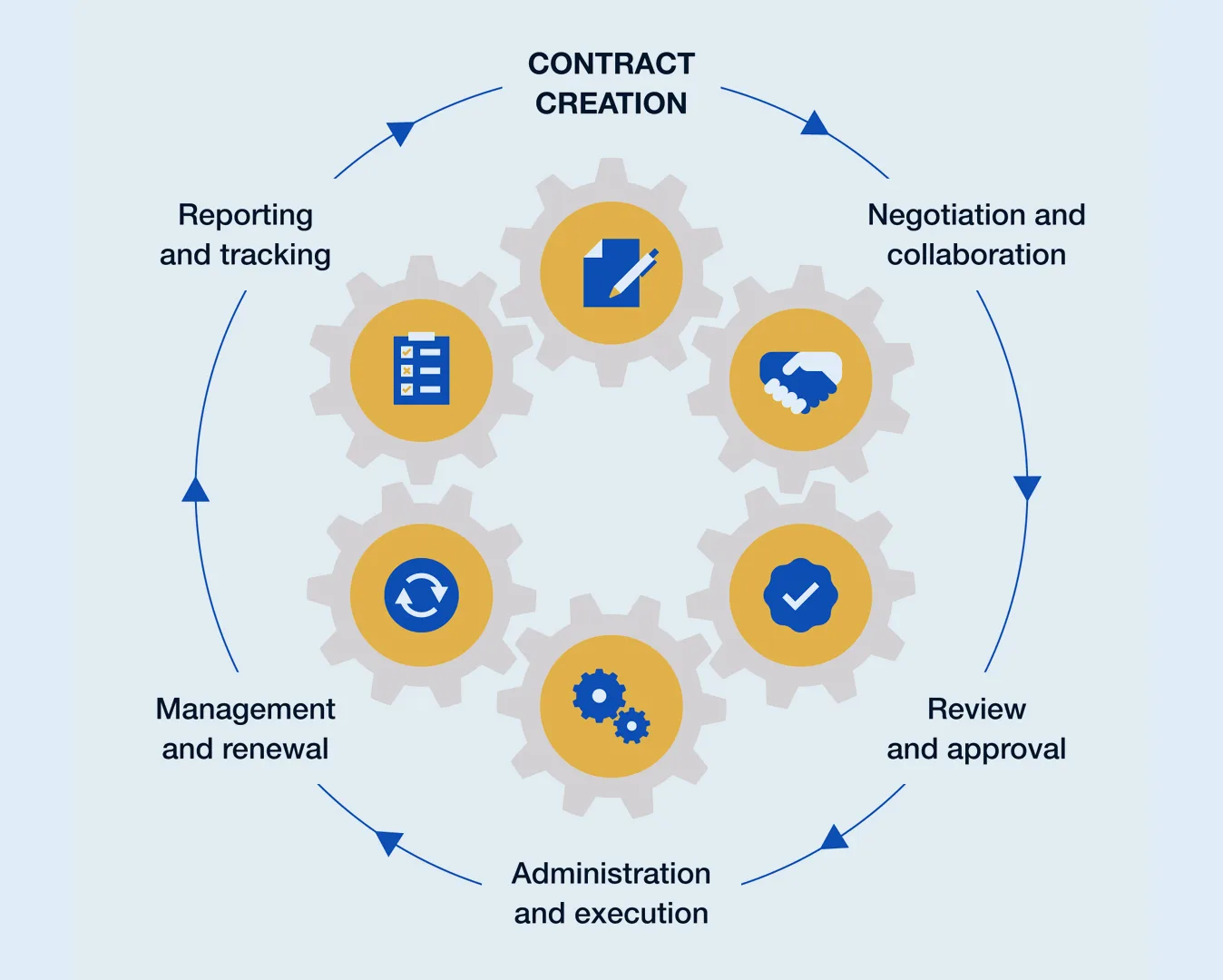

- Automated Workflows and AI Integration: Fintech relies on speed and efficiency. Implementing automated workflows within the CLM system streamlines contract processes, reducing time-to-signature and improving operational efficiency. Integration of AI for contract analysis, risk assessment, and predictive analytics can further enhance decision-making.

- Auditing and Reporting Capabilities: Fintech firms need robust auditing and reporting features within the CLM system to track compliance, analyze contract performance, and generate reports for regulatory purposes or internal audits.

- User Experience and Training: The CLM system should have a user-friendly interface. Training programs should be in place to ensure that employees understand how to navigate and utilize the system effectively.

- Contract Analytics and Insights: Fintech companies rely on data-driven insights. The CLM system should offer analytics capabilities to provide insights into contract performance, risks, and opportunities, aiding in strategic decision-making.

- Collaboration and Communication Tools: Enhanced collaboration features within the CLM system facilitate seamless communication among different stakeholders, improving negotiation processes and reducing delays.

- Continuous Compliance Monitoring: Implementing a CLM system isn’t a one-time task. It requires continuous monitoring and updates to ensure ongoing compliance with changing regulations and industry standards.

Implementing a CLM system in the fintech world demands a balance between robust security measures, regulatory adherence, seamless integration, and enhanced efficiency. This implementation, when done effectively, can streamline contract processes, reduce risks, and contribute significantly to the success of fintech ventures.